Unveiling the Crucial Role of Pay Stubs in Mortgage Applications and Budget Planning

Explore the vital role of pay stubs in the home buying journey, from securing a mortgage to planning a realistic budget. This article delves into the significance of pay stubs in lenders’ evaluations, offering actionable advice on enhancing financial profiles with an emphasis on using a pay stub generator for accurate income tracking.

Introduction:

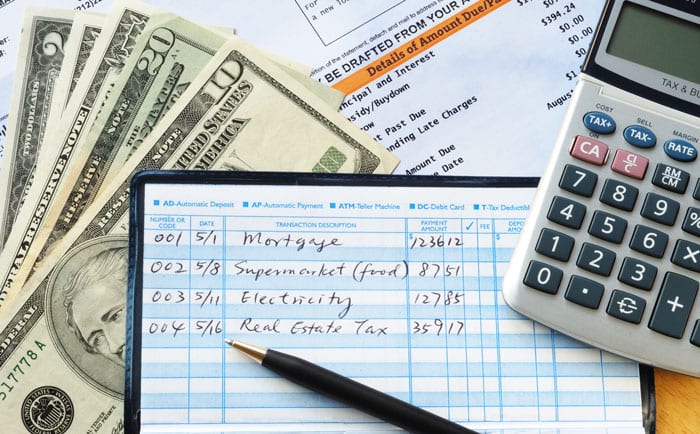

In the quest to purchase a dream home, navigating the financial intricacies can be daunting. At the heart of this journey lies a crucial yet often overlooked component: pay stubs. These humble pieces of paper are more than mere earnings statements; they are gatekeepers to realizing homeownership dreams. Pay stubs are pivotal in mortgage applications, providing lenders with a snapshot of an applicant’s financial health. They also play a key role in personal financial planning, helping aspiring homeowners assess their true budget for a home purchase.

This article aims to shed light on the multifaceted role of pay stubs in the home buying process. From influencing lender decisions to aiding in accurate budget planning, understanding the power of these financial documents is key. Furthermore, we will explore how the use of a pay stub generator can streamline the process, ensuring that your financial records are both accurate and up-to-date, a vital step towards successful homeownership.

Section 1: The Role of Pay Stubs in Mortgage Applications

Overview

In the realm of mortgage applications, pay stubs are not just formalities but foundational documents. They provide lenders with a tangible record of an applicant’s earning history, crucial for assessing loan eligibility.

Income Verification

A pay stub is the most direct proof of income, detailing earnings before and after deductions. Lenders rely on this information to verify that the applicant has a stable source of income sufficient to cover monthly mortgage payments.

Consistency and Stability

Beyond the numbers, lenders scrutinize pay stubs for consistency and stability in income. Regular pay, without significant fluctuations, is seen as a sign of a dependable borrower. This is particularly important in industries where income can be variable.

The Pay Stub Generator Advantage

In today’s digital age, a pay stub generator is a valuable tool. It allows individuals to create accurate, up-to-date pay stubs, reflecting their current financial status. This is especially beneficial for freelancers or self-employed individuals who may not receive regular pay stubs from an employer. By using a pay stub generator, applicants can provide lenders with a clear, consistent record of their earnings, thereby strengthening their mortgage application.

Section 2: Assessing Your Home Buying Budget with Pay Stubs

Realistic Budgeting

Pay stubs are instrumental in formulating a realistic home buying budget. They provide a clear picture of your net income, which is the foundation for determining how much house you can afford.

Understanding Debt-to-Income Ratio (DTI)

The DTI ratio is a critical metric in mortgage applications, calculated by dividing total monthly debt payments by gross monthly income, as evidenced by your pay stubs. A lower DTI ratio is preferable, as it indicates that a smaller portion of your income is going towards debt, leaving more room for a potential mortgage payment.

The Role of Additional Income

Income from overtime, bonuses, or side jobs, when consistently reflected on pay stubs, can positively influence your home buying power. Lenders often consider this additional income, especially if it is regular and can be documented over a period.

Using a Pay Stub Generator for Budget Planning

For individuals whose income varies, a pay stub generator becomes a crucial tool. It allows for the regular updating of income details, providing a more accurate and up-to-date basis for budget planning. This can be particularly useful for adjusting your home buying budget in response to changes in your financial situation.

Section 3: How Lenders View Income Stability and Debt-to-Income Ratios

Income Stability

Lenders typically favor borrowers who demonstrate income stability. This is often assessed through a historical review of pay stubs. Consistent pay over a significant period, without large gaps or frequent job changes, is ideal. This stability suggests a lower risk of loan default, making the borrower a more attractive candidate for a mortgage.

The Importance of Low DTI

A key factor in the mortgage approval process is the debt-to-income ratio. Lenders prefer a lower DTI, as it indicates that a borrower has enough income to comfortably manage additional debt. Regular pay stubs help in calculating a precise DTI, showing lenders a clear picture of an applicant’s financial commitments relative to their income.

Improving Your DTI

Improving your DTI involves either increasing your income or decreasing your debts. Paying off high-interest debts, avoiding new debts, and, if possible, increasing income through additional work can help improve this ratio. Regularly updating your pay stubs using a pay stub generator can reflect these positive changes, making for a stronger loan application.

Pay Stub Generator as a Financial Tool

A pay stub generator serves as an essential tool for individuals to monitor their financial health, especially when preparing for a mortgage application. By regularly updating income details, borrowers can keep a close eye on their DTI ratio and make informed decisions to improve their financial standing.

Section 4: Enhancing Your Financial Profile Before Applying for a Mortgage

Financial Health Check

Before applying for a mortgage, conducting a thorough review of your financial health is crucial. Analyzing pay stubs helps in identifying income patterns, understanding spending habits, and recognizing areas where financial improvements can be made.

Reducing Debt and Increasing Savings

Reducing outstanding debts and increasing savings are fundamental steps in enhancing your financial profile. Pay stubs play a vital role in this process by providing a clear view of your disposable income, which can be directed towards debt reduction and savings.

Regular Income Documentation

Maintaining updated and accurate income documentation is crucial. A pay stub generator facilitates this by enabling the creation of regular, precise pay stubs, reflecting any changes in income, such as raises or additional earnings. This continuous documentation is beneficial when presenting your financial status to lenders.

Consulting Financial Advisors

Seeking advice from financial advisors is a wise step in preparing for a mortgage. Armed with accurate and up-to-date pay stubs, you can receive tailored advice on improving your financial situation, enhancing your eligibility for a mortgage.

Conclusion: Harnessing the Power of Pay Stubs for Homeownership Success

In the intricate dance of purchasing a home, the humble pay stub emerges as a star performer. As we have explored, these documents are far more than simple earnings statements; they are the bedrock upon which mortgage applications are assessed and home buying budgets are built. The importance of presenting a clear, consistent, and comprehensive financial picture to lenders cannot be overstated, and pay stubs are central to this presentation.

The use of a pay stub generator plays a pivotal role in this process. It empowers individuals, especially those with variable incomes, to maintain accurate and current records of their earnings. This tool is invaluable not only in ensuring that your mortgage application reflects your true financial capacity but also in helping you to realistically plan and prepare for the financial responsibilities of homeownership.

Furthermore, understanding and improving your financial profile through careful analysis of pay stubs can significantly enhance your attractiveness to lenders. By reducing debts, increasing savings, and keeping a vigilant eye on your debt-to-income ratio, you can position yourself as a desirable candidate for a mortgage.

In conclusion, the journey to homeownership is a path paved with numerous financial considerations, and pay stubs are key milestones along this route. Whether you are just starting to consider buying a home or are in the midst of preparing your mortgage application, remember the power of proof that lies within your pay stubs. Accurate, up-to-date, and well-managed financial records, bolstered by the use of a reliable pay stub generator, can make all the difference in turning your homeownership dreams into reality.